Keep an Eye On Budgeting and Planning with Infor dEPM

Infor Budget And Performance Management

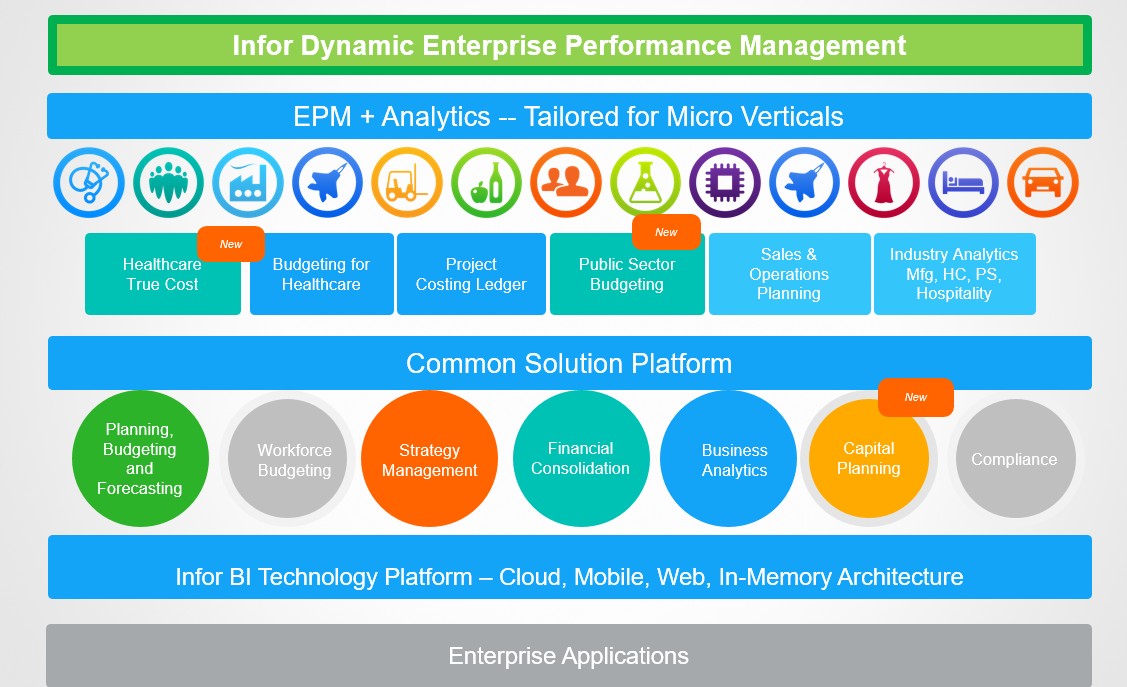

Combining the best of Business Intelligence, budget and Performance Management, Infor dEPM is a flexible solution that is easily customisable for each organisation environment. Some key functions include financial and operational planning, forecasting, financial consolidation, reporting and business analysis. This solution can be integrated with Sunsystems, as well as many financial and operational databases.

With Infor dEPM, organisations are able to link and collect various sources of data into a single instance of information. This allows high-level management business analytics and detailed drill-down reporting from the same dataset. Consolidation Software: a combination of automated processes, guided workflow capabilities, built-in financial functions, and a standardised user interface allows for a more efficient and effective management.

Consolidation Software

The solution’s web-based structure allows for data collection from various business units around the world. Integrated import functionalities enable for mapping of different general ledger systems, chart of accounts and ERP systems into a standardised consolidated group structure. It also ensures that the entire organisation can access the same set of numbers at any time via web browser or an Excel add-in, resulting in greater control and confidence in the numbers. Data is consolidated in line with local and international requirements such as GAAP, Sarbanes-Oxley and IFRS. Consolidation software can also be performed on budget and forecast data from the Budgeting and Planning module of Infor dEPM, which provides for better business performance management insight. The solution allows for automated consistent group journal postings that allows for a more efficient consolidation process. Paired with detailed audit trail, Infor dEPM provides financial reporting transparency that satisfies both auditors and shareholders.

Business Budget Planning

Infor dEPM provides a common platform for organisations to leverage on a more efficient budget data gathering and business budget planning. This eliminates the need to re-key budget data and the confusion of various spreadsheets, thus reducing data transfer errors as well as version-control issues. The solution comes with structured planner and approver workflow that allows for various comments to be tagged on the data. The Budgeting & Planning module is pre-packaged with detailed sub-plans like Sales Planning, Workforce Budgeting and Capital Planning that is customisable for each organisation’s requirements. It is also able to support allocation of costs by specific drivers, as well as phasing of amounts by user-defined parameters such as headcount or seasonalilty. As Infor dEPM is on a single database, there is easy comparison of budget, forecast and actual results. The budget and forecast amounts can also be pushed to the dEPM Consolidation module for group budget analysis.

Performance Management – Budgeting & Planning Benefits

- Reduce the time needed to collect data and prepare budgets.

- Eliminate version-control issues.

- Automate roll-ups, calculations, and currency conversions to save time and reduce errors.

- Monitor budget submissions and actual results for increased accountability.

- Plan salaries and assets at the detail level for more accurate budgets.

- Set up automatic alerts to notify you when something unexpected is happening, so you can take action.

- Adjust budgets and communicate changes when business conditions change, maintaining the plans relevancy and commitment of the organization.Use results to set realistic business performance expectations for employees, management, shareholders, and others.

Performance Management – Financial Consolidation Benefits

- Adhere to local and global accounting standards and reporting requirements such as GAAP, FASB, IAS, IFRS, and Sarbanes-Oxley.

- Gain more process control through the centralized storage and maintenance of data.

- Speed financial consolidation and reporting by automating key processes such as data loading, consolidation, and verification.

- Collect, process, report, and analyze data in multiple currencies, and report on the impact of currency fluctuations.

- Carry out automated adjustments including minority interest, intercompany eliminations, recurring adjustments, cost allocation and miscellaneous adjustments.

- Consolidate data from various business perspectives (geographic region, product line, etc.) and multiple structure versions (this year/month VS last year/month, etc).

- Turn data into useful information by comparing results against budgets and forecasts.